Genette’s 5 Tips for Extended Warranty Plans

Your phone rings. It is an unknown number. You stare at the screen and maybe you debate whether to answer. It didn’t say “SCAM LIKELY,” so you press the green icon and say “Hello?”

“We’ve been trying to reach you about your car’s warranty!”

Sigh, disconnect…

The fact is, there are tons of programs out there and they are NOT created equally. When new clients call, they will often ask if we work with their extended warranty company. I also get asked what company I would recommend when my existing clients are considering coverage. Let’s explore what this coverage actually is, what you the consumer get, and if it is worth it.

We are an approved vendor for nearly all insurance companies, extended warranty companies, and fleet management companies. Over the past 30 years, I have honed my skills in this industry, learning the steps these companies require to move your repair service from start to finish.

Advertising

This is where I feel most of the public can be grossly misled. Words are thrown around like “free” and “no cost to you.” A radio ad played recently stated your car would be towed at no cost to you, and you would have rental car coverage at no cost to you. This is a fantastic hook.

These are two of the biggest “pains” when you have a car breakdown. How are you going to get your car to the repair shop? How will you get around while your car is in the repair shop? In our area, a tow service can start at $80 to “hook up” and $3 per mile. A rental car can be ~$50 per day (including taxes and fees). These “pains” are also two expenses that do not go towards the cost of repair—you have incurred these fees and haven’t even fixed anything yet. Ouch. Of course, a plan that “covers” these expenses for you looks attractive!

Tip #1: Confirm the fringe benefit coverage.

When shopping for your plan, look at the fine print. Who pays for the tow service? Do you have to pay for it and get reimbursed? Does it cap at a specific dollar amount? If the breakdown is not covered, is the tow still covered? Is there a maximum number of tows per incident—what if you tow it to your home while you find a reputable auto repair shop?

The same applies to your rental car coverage. I have come across outdated contracts that still have rental cars at $35 per day. Some other questions you may want to ask are when does rental coverage start—does it start at vehicle drop off or when repairs are approved? Is there a maximum allowance? Some contracts only allow rental coverage when the labor guide time will be more than a certain number of hours. Your car could be at the shop for several days waiting for approval, but if the labor guide says the repair takes four hours, that could mean no rental car coverage.

These answers need to be in writing in your contract. Since the salesperson is not the agent who authorizes repairs or claims, anything they say to you really doesn’t matter.

The Whole Package

Affordable and easy. That is the idea behind many of these programs. The salesperson wants to help find the package that fits your budget and your needs. They may be called different things like Bronze, Silver, Gold, or Platinum. You may hear Basic, Standard, Comprehensive, Premium, and Ultimate.

One thing I want you to keep in mind is that the salesperson is usually NOT a repair expert. They may not know your car, your systems, and what you need.

TIP #2: What kind of coverage do you really need?

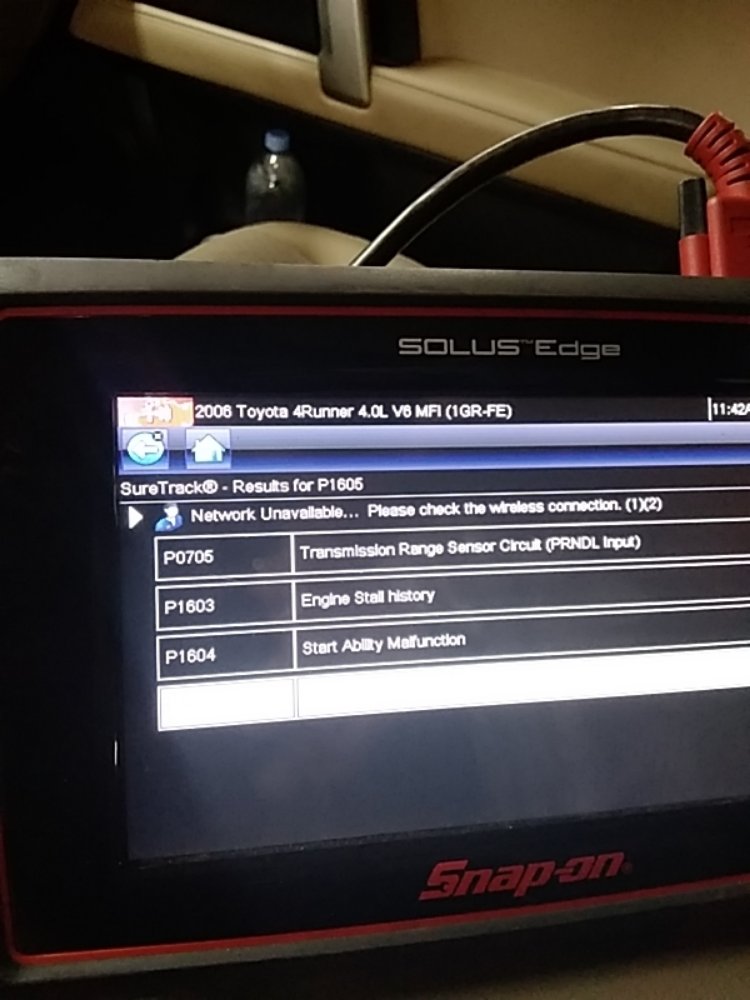

The level of coverage you purchase depends on what you are looking for and what your car is equipped with. Most basic plans are usually “drivetrain” only. What does that mean? Well, that means the engine, transmission, and differentials would be covered. As it is basic, it is just that. Basic. The guts of those parts are covered, meaning an internal failure would have to occur. I want to pause here. When was the last time you recall having an internal failure of a major component? Now, is this the type of coverage you need? In most cases, the answer is no.

Modern cars have more electrical parts like modules and sensors. Consider the difference in cost between a basic plan and something more robust that covers electronics and all systems. Look for something that will cover the exterior parts of your major components too. Something else to consider would be programming your computer-related parts. When modules and sensors are replaced, programming may be required. A good plan will include parts and services along with the necessary repair.

Here is an example: A Mini Cooper overheated. The client had an extended warranty policy. The cause of the overheating was covered (parts and labor). When the engine overheated, it damaged the power steering module. The power steering module replacement was also covered (parts and labor). However, module/computer programming was not covered in the client’s policy. While it was necessary to make the new module work, it was just not covered, and the client had to pay out of pocket on top of her deductible.

The Process

Different extended warranty companies have different processes for filing claims. Regardless of whether the auto repair shop initiates a claim online or by telephone, they all begin with the same thing. Car identification, policy or contract number, current mileage, and reason for visit. Where they begin to differ is in the authorization process. Some companies are easy; it is cut-and-dry. This part failed, this is the cost to repair, here is your authorized amount, and here is your authorization number. Others…not so much.

Tip #3: What is the claim process?

The first thing I let all my clients know is that the warranty company will expect a diagnosis to be performed. You, the client, must authorize the diagnosis and your warranty company may cover the fee if it is a covered repair. What does that mean?

Your car is overheating. You authorize the fee for me to test and determine why it is overheating. I found out it was a water pump. I called your warranty company and told them you need a water pump. I give them the cost of the test, and the parts and labor for the water pump. It is covered. The warranty company picks up the cost of the diagnosis fee you authorized. Or the opposite:

The water pump is NOT covered. You, the client, would be responsible for the diagnosis fee. The claim is closed, and the repair is between me and you.

Tip #4 Read the fine print.

When it comes to the claims process, there is a lot of fine print. Here are a few things I thought I would share with you. Some companies allow their claims adjusters to authorize up to a certain dollar amount. Once an estimate reaches that threshold, the process stops. Cold. There is a clause in most contracts that allows the warranty company to send an adjuster out to inspect the car. This step takes up to two business days. The warranty company contracts with an outside adjuster who sets up a day to come to the repair shop and inspect the area of repair. The adjuster will take images and write a report. Then, this goes back to the warranty company for authorization. How does this affect you, my client, and me, the repair shop?

Your car has been disassembled since the original diagnosis. It has remained that way, waiting for the adjuster for two business days. It remains that way until the adjuster’s report gets back to the claims department where an agent will decide if your repair will be authorized or not. This part of the process can add up to 4 business days to just the authorization. Your car still has to be repaired.

I do my best to avoid this time delay by sending images directly to the warranty company. All our services come with Digital Vehicle Inspections. My technicians can capture images and videos, and organize them into a detailed report. We then send a link to an email or cell phone for both the client and the warranty company.

Another part of the fine print details coverage amounts. There is a misconception again in the advertising and sales pitch about coverage. The warranty company does not set the auto repair shop’s rates and fees. Just like you cannot go into a restaurant and tell them how much you are going to pay for the Surf and Turf, another business cannot dictate what a repair shop can and cannot charge. Some warranty companies will pay the repair shop’s posted labor rate. Others may pay up to a specific dollar amount. When it comes to parts, it is very similar. The company will pay up to a specific dollar amount or want to use their supplied part. How does this look in print?

When is free not really free?

I keep my clients informed every step of the way. The estimates and invoices that I submit to the warranty company look exactly like the ones I give to my client. I may submit an estimate to my client (parts, labor, tax, and fees) of $595.62. I submitted the exact same estimate to the warranty company. The warranty company states they will pay $450.00 less the client’s $100 deductible for a total of $350. The client will be responsible for $245.62.

Tip #5 Your Auto Repair Shop Is On Your Side

The fine print is very important. Whenever you can, make your contract available to your repair shop. Highlight what is and is not covered. The more I know up front, the better advocate I can be for you and your car. I can set expectations with you in the beginning and clear up any concerns you may have before we begin.

The Amazing A. Anthony’s Team!

I want to get your car repaired and back on the road as quickly as possible, whether you use an extended warranty company or not. Should you have one, I want you to get the benefits from your policy. My ultimate goal is to take care of you and your car. Your car is one of your biggest investments. My team and I can be one of the partners you choose to protect it. We are here for you!

This is a great post. Knowing what you are paying for when you get an extended warranty is a must. Thanks for always being relevant.

LikeLike

Not sure if my first reply was posted.

This is great information for those who no longer have a manufacturers warranty. Knowing what you are getting for your money is always the right call. Thanks for staying relevant. These days every dollar saved is a bonus

LikeLike

Travel Monkey, thank you for your support! I am glad you liked this article. Please let me know if there are any topics you would like to see in future posts!

LikeLike

This is an incredibly informative guide on extended warranties! Genette’s tips on understanding coverage, the claims process, and the importance of clear communication with your repair car shop are invaluable. Great insights for anyone navigating this complex landscape! Thank you for sharing!

LikeLike